What is a Downround? Key Takeaways for Founders

Agustin Nobili

April 8th, 2025

What is a downround?

A down round occurs when a private company issues additional shares at a price per share lower than in its previous financing round. This happens when the company’s pre-money valuation in the latest round is lower than the post-money valuation established in the previous round.

As you can see in the chart above, the company secured CHF 4M in Series A funding at a CHF 12M pre-money valuation, resulting in a post-money valuation of CHF 16M. However, Series B was a down round, as its CHF 12M pre-money valuation was lower than the CHF 16M post-money valuation of Series A. While Series B's post-money valuation increased due to the CHF 6M raised, the drop from the post-money valuation of Series A to the pre-money valuation of Series B confirms that this was a down round.

Common drivers of a downround:

- Market Conditions: Economic downturns, sector-specific challenges, or reduced investor interest can compress valuations.

- Missed Targets: Failing to meet growth, revenue, product or other milestones erodes investor confidence.

- Overvaluation: Inflated prior valuations that were not supported by fundamentals.

- Competitive Pressures: Increased competition or loss of differentiation impacts growth prospects and investor perception.

- Urgent Funding Needs: Cash shortages or limited alternatives force companies to accept lower valuations.

Why have down rounds increased across the market?

Interest rates significantly influence valuations in public markets, directly affecting the cost of capital and valuation metrics such as multiples. In private markets, however, their impact is more indirect but still substantial. While rising rates increase the cost of debt and affect valuations, private market valuations are often shaped by broader factors, such as investor sentiment, industry trends, and the company's specific performance. As a result, the link between interest rates and valuations in private markets is typically less direct and pronounced than in public markets.

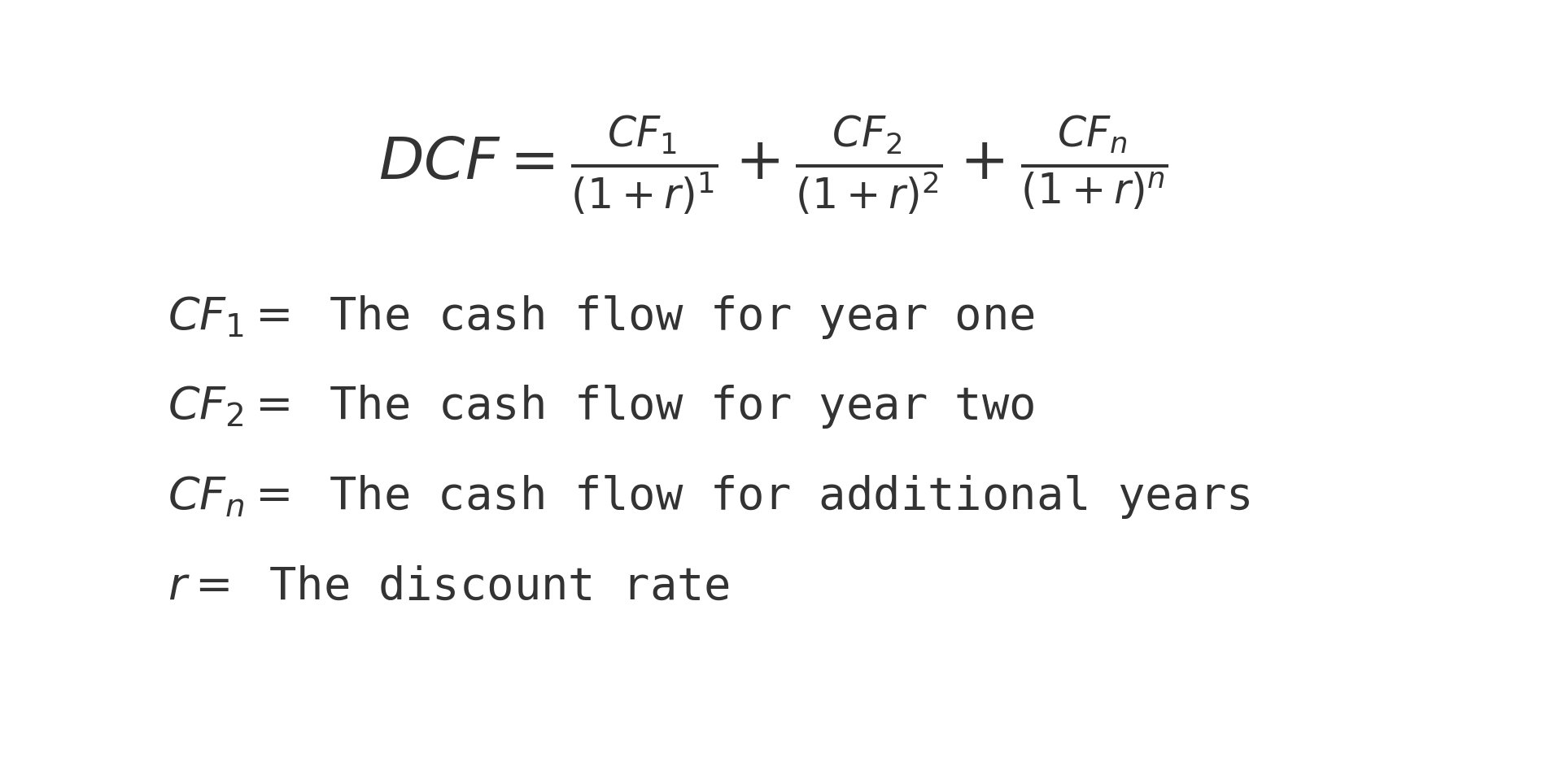

In private markets, and particularly for tech companies, the most significant effect of rising interest rates is the decline in valuations. Discounted cash flow (DCF) valuations are not the go-to methodology for scaling tech companies since, in their early days, most of them had negative cash flows. Using this methodology would not work, however, the theory behind DCF also applies as higher interest rates increase the discount rate, reducing the present value of future cash flows. For high-growth tech companies that rely on long-term projections to justify their valuations, this shift has been particularly significant.

Discounted Cash Flow (DCF) Formula

Rising rates also lead investors to favor fixed-income assets, which offer stable returns with lower risk compared to equities. This shift in capital allocation puts additional downward pressure on valuations, particularly for companies reliant on venture funding.

The post-COVID recovery period provides a clear example of these dynamics. In 2020, central banks, including the Federal Reserve, lowered interest rates to near zero to stimulate economic activity, driving record-high valuations in tech and growth sectors. As rates began to climb in subsequent years, these elevated valuations faced significant corrections, particularly in industries like technology.

As interest rates rose in 2021-2022 to curb inflation, monetary tightening and public market volatility triggered a sharp drop in private tech valuations. By Q4 2022, median valuations saw modest declines at Seed and Series A but fell sharply at later stages: Series B (-46%), Series C (-55%), Series D (-58%), and Series E+ (-72%).

In private markets, the dynamics differ: unlike in public companies, where typically all shareholders hold the same share class, in private companies it is normal to have different share classes with differing terms such as liquidation preferences. Consequently, down rounds have a distinctly different impact due to this asymmetry, affecting more profoundly the common shareholders who typically are the founding team and employees.

Options to Navigate a Down Round

When facing a potential down round, founders have several options, each with trade-offs.

- Renegotiating terms with investors can offer creative solutions, such as waiving anti-dilution provisions or adjusting liquidation preferences. These adjustments may preserve the company’s valuation in the short term while satisfying investor concerns. However, founders must carefully evaluate the long-term impact of these changes on equity structure and ensure they do not disproportionately affect common shareholders.

- Financing options, including bridge loans, convertible loans, venture debt, or non-dilutive growth loans, can delay a down round by providing liquidity without immediately setting a valuation. Founders should align these strategies with their financial goals and growth plans, balancing short-term needs against future obligations.

Turning a Down Round into and Opportunity and Key Takeaways for Founders

Down rounds are more than just a financial adjustment, they carry significant implications for both founders and their companies, leading to significant ownership dilution that can impact the company’s trajectory and the founder’s ability to drive its vision.

Founders can explore various options to manage challenging times effectively, including strategies like renegotiating terms with existing investors or securing alternative financing. While these approaches can help preserve value and control, a down round is not inherently negative. In some situations, accepting one can be a strategic decision to ensure the company’s survival and create opportunities for long-term success. Let’s not forget that in public markets, down-round equivalents happen all the time.

Ultimately, the key is preparation. Avoiding raising more than needed, building realistic valuations, maintaining strong investor relationships, and planning can help minimize the likelihood of a down round. When approached strategically, even a down round can be an opportunity to reset and position the company for sustainable growth. By acting decisively and with clarity, founders can navigate these challenges while protecting their business and vision.

Learn more about Industry Insights

A Healthy B2B SaaS From a Debt Investor Perspective

Tag: Industry Insights

Hardware-as-a-Service: Understanding the Business Model

Tag: Industry Insights