Bridge rounds for Swiss SaaS: What to consider

March 29, 2023Growth Loans vs Series A or B:

Pros and Cons of Each

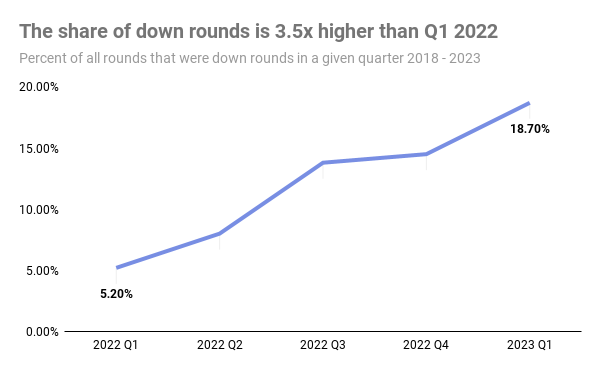

The market sentiment for VC investments has significantly shifted from early 2022. Since then, fewer investments have been made and terms are less favorable for companies raising funds. As a result, Almost 20% of all rounds completed in 1Q 2023 were “down rounds”, a 3.5x increase vs 2022.

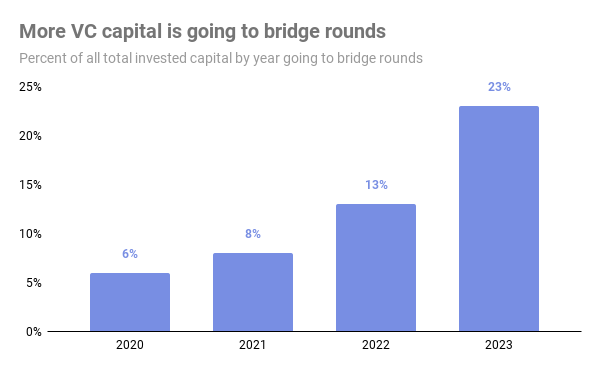

The reality might be even worse given the “hidden dilution”. Since down rounds are psychologically and financially painful for founders and investors, many times they agree to “sugar-coated” flat rounds. These are flat rounds from a valuation perspective but include terms such as more onerous liquidation preferences, strict anti-dilution provisions, renewed vesting schedules, wide veto rights and/or increased ESOPs allocations from the founders' pot. Flat rounds were only 6% of VC invested money in 2022 and are now 23%. In a recent article, we covered what should founders consider when doing a bridge round.

This new reality has accelerated the shift from growth at all costs to profitability. Since capital becomes less available and more expensive, companies need to focus on profitability. However, doing this abruptly has its consequences.

Kill the growth and innovation engine ?

Companies that have healthy growth metrics and are post-product market fit could keep generating value by finding the right balance between adjusting burn and keeping the growth and innovation engine. In this case, companies can build a path to profitability that will likely need the last external funding, at least until markets become more founder-friendly again.

So, which is the right capital ?

It all depends on the vision of the company, its metrics, what the founding team is looking to build, and how all this fits together.

Considerations when choosing the right capital

- Will my company be eligible to get additional external funding?

- How long will it take and what does the process look like?

- Am I in a winner-takes-it-all industry and need to grow at all costs?

- How have I been financed so far?

- What does my current cap table look like and what is my actual dilution level? Are we too diluted?

- Are the team motivation and upside potential still there?

- Are ESOPs in the money or not? Will this be a problem to retain and hire?

- What will I use the money for? Will it achieve a good ROI?

- What will be real the cost of funding?

- How flexible will this capital be?

- Does it come with specific exit requirements? What do I want to do with my company next?

Companies that are growing and are post-PMF, might have several options. If a company is internationally active, is in a winner-takes-it-all market, and has very strong metrics including a higher than 100% year-on-year growth, then probably equity will be the external capital that makes the most sense.

Companies that are positioned to win a market niche, are growing at 20% to 80% year-on-year, and have sales efficiency, might have access to both equity and debt. However, sometimes an equity round might not be the right capital. In a recent article, we covered why even a flat round might not work.

Let's take a look at the Pros and Cons of each option.

Equity: Series A or B

Pros

- Typically larger amounts are available

- Can help as a marketing tool to attract talent

- Does not need to be paid back before exit

- Can work for specific use cases such as:

- Winner takes it all markets

- Long research and development phases before revenues

- Strong client concentration

- Intense CAPEX needs

Cons

- Dilutes ownership for founders, employees, and existing shareholders

- Can't go back from it

- Creates loss of control for the founders including reduced power to set the direction of the company and potential conflicts of interest

- Often comes with “hidden dilution” (liquidation preferences, anti-dilution provisions, renewed vesting schedule, ESOPs, veto rights)

- Time consuming, scarce, requires team focus shift from business, and is uncertain to be obtained until the end

- At times, pushed too far, too fast

- Needs a return expectation of at least 10x

Lendity Growth: Non-dilutive Growth Capital

Pros

- Typically the least expensive available capital

- Completely non-dilutive

- Flexible payback since the payback can be linked to revenues

- Long-term capital: up to 5 years to allow value-creating initiatives

- Doesn’t need profitability at disbursement (needs a path to profitability)

- No loss of control, no board seats, and no unsolicited involvement

- No new shareholders and hence no change of valuation

- Independent of equity raise. Works alongside VC capital or without it

- Fast process with early visibility

- Keep full optionality for the future: another debt tranche, bank debt, equity, sell or keep the business

- No exit is needed so no pressure about it

- Positive external message due to the company's solid KPIs to pass debt due-diligence

- The facility size can increase with revenue growth

Cons

- Only eligible for companies with healthy metrics

- Post product-market-fit

- Growing

- High gross margins

- Positive unit economics

- No client concentration

- Needs to be generating sufficient revenue

- Not the last resource option

- Not eligible when a company is overindebted

- Needs to be paid back

- Needs a minimum of 6 months of runway or equivalent new equity raise

Combining Equity and Debt

Since these two sources of funds work well together, in many cases, they are combined to obtain the benefits of both, a long runway to build a path to profitability keeping growth and innovation, while maximizing control and keeping dilution as low as possible.

The importance of capital and vision alignment

In the end, the founding and managing team are the ones best equipped to decide which capital is the right one. It is crucial that the capital used is well aligned with what the company is building and what direction the company is going. Making a mistake here will prove to be very expensive down the road. This is an important decision and the options considered need to make sense with realistic expectations.

Lendity Growth provides founder-friendly non-dilutive growth capital for the Swiss Tech industry. Want to know more? Click here.

We strive for the right capital, at the right time, for the right use.

Learn more about Funding Strategies

Cost of Capital: A Guide for Startup Founders

Tag: Funding Strategies

Bridge rounds for Swiss SaaS

Tag: Funding Strategies