Cost of Capital : A Guide For Startup Founders

Part 1 of a 4-Article Series: Exploring the Cost of Capital

Nicolas Gallo

November 28, 2024

For Tech startup founders, understanding the cost of capital is more than a financial exercise—it’s a strategic imperative. This fundamental concept underpins decisions about how to fund growth and shapes the financial trajectory of a business. The cost of capital impacts not only the financing mix of your company but also its financial flexibility, resource allocation, and, most critically, the level of ownership and decision-making power retained by founders. These implications extend beyond numbers, influencing how your business evolves and succeeds in a competitive market.

This article marks the beginning of a series aimed at empowering Tech founders to navigate their complex funding journeys. Our goal is to clarify concepts that are well-understood in mature companies and business schools but often misunderstood—or overlooked—by founders from technical backgrounds.

Most Tech businesses (and particularly SaaS ones) operate under unique financial dynamics, characterized by their subscription-based revenue models, high upfront costs, and delayed returns. These features demand a more nuanced approach to understanding and managing the cost of capital, as traditional methods often fail to capture the realities of high-growth startups. In this article, we’ll define the cost of capital, explain the classic approach used by mature businesses, and explore why this framework falls short for Tech startups.

What is the Cost of Capital?

At its core, the cost of capital represents the price a company pays for external funding. It’s the return expected by investors or lenders in exchange for providing that capital, whether through interest payments on debt or returns on equity investment.

The primary sources of external capital are debt and equity. While alternative funding options are available—particularly for startups—this discussion will focus on these traditional sources as a foundation. We’ll address alternative funding mechanisms in future articles, but for now, let’s assume a straightforward scenario to establish the basics.

The Classic Cost of Capital approach:

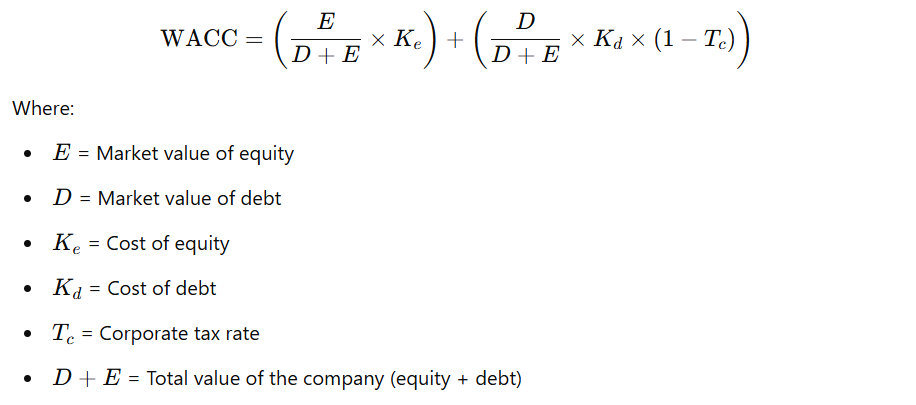

For traditional businesses with stable revenues and predictable cash flows, calculating the cost of capital is relatively straightforward. The most widely used method is the Weighted Average Cost of Capital (WACC), which averages the costs of debt and equity based on their proportions in the company’s capital structure.

Cost of Debt (Kd)

This is the interest rate paid on borrowed funds, such as loans or bonds. For established businesses with stable cash flows, the cost of debt is typically low, reflecting reduced risk for lenders. Furthermore, interest payments are generally tax-deductible, creating what’s known as a tax shield, which effectively lowers the cost of debt.

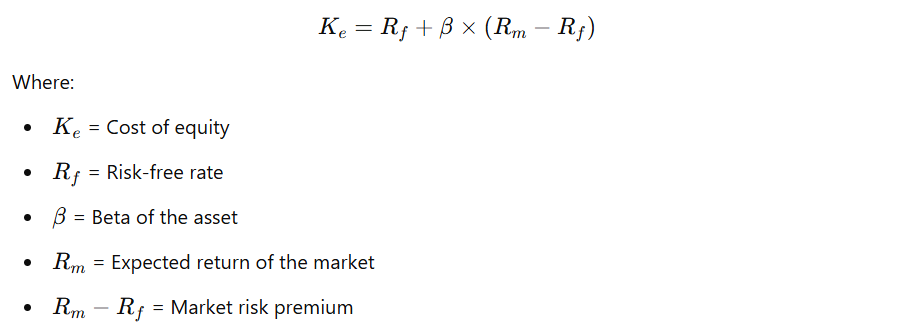

Cost of Equity (Ke)

The cost of equity is the return expected by investors in exchange for assuming higher risk. Equity investors bear greater uncertainty compared to debt holders, as they are compensated only if the company performs well. The most common method for calculating the cost of equity is the Capital Asset Pricing Model (CAPM). This model incorporates the risk-free rate, an equity risk premium, and the company’s beta—a measure of how the company’s returns correlate with broader market performance.

The WACC approach works well for businesses with stable cash flows, such as those selling physical products or providing long-term service contracts. In these cases, the cost of capital is largely determined by interest rates and the company’s risk profile.

Why the Classic Approach Doesn't Work for High-Growth Tech Startups

For high-growth Tech companies, the traditional approach to calculating the cost of capital, particularly the CAPM for equity, is largely ineffective. Here’s why:

The CAPM assumption is misaligned with startup risk

CAPM assumes that a company’s risk premium is correlated with stock market returns. However, Tech startups are significantly riskier than public market benchmarks, making this comparison irrelevant. The return expectations for investors in high-growth startups far exceed those of mature companies due to the heightened uncertainty and longer timelines for profitability.

Volatile and negative cash flows

Unlike mature businesses, Tech startups often face negative cash flows for years. High customer acquisition costs (CAC), coupled with long sales cycles and ongoing R&D investments, require substantial upfront capital. Even in scenarios where the customer lifetime value (LTV) is strong, revenue is earned incrementally through subscriptions, creating a time gap between investment and returns.

Growth is a necessity, not a choice

Mature companies can decide annually how aggressively they want to pursue growth and whether to fund it through retained earnings or external financing. For Tech startups, growth is non-negotiable. They must invest heavily to build a strong customer base and continuously enhance their product offerings to remain competitive. Reducing spending prematurely could stagnate growth and threaten the business, given the fast-paced and competitive nature of the Tech market.

A New Approach to Cost of Capital for Tech Startups

For Tech founders, understanding the cost of capital requires a tailored approach that reflects the realities of high-growth businesses. Traditional methods, like WACC and CAPM, fail to account for the volatility, prolonged negative cash flows, and strategic trade-offs unique to Tech companies.

Startup founders must carefully consider several critical factors when evaluating their cost of capital and funding options. One of the most significant challenges lies in managing the inherent time gap between substantial upfront expenses, such as customer acquisition costs, and the gradual realization of recurring revenue through subscription-based models. Additionally, founders face the delicate task of balancing the trade-offs between equity financing, which often entails dilution of ownership and control, and debt financing, which requires higher financial discipline but preserves equity. It is imperative to prioritize funding strategies that strike the right balance between growth objectives and profitability. By addressing these challenges with a strategic and informed approach, founders can optimize their financing decisions to support sustainable growth and strengthen their company’s financial trajectory.

Conclusion

The cost of capital is more than a financial metric—it’s a strategic tool that shapes the decisions founders make about funding and growth. While traditional methods like WACC and CAPM provide a solid foundation for mature companies, they fall short for high-growth Tech businesses. A nuanced understanding of these limitations empowers founders to navigate their funding journeys with confidence, secure the right type of capital, and make decisions that align with their long-term vision.

In upcoming articles, we’ll dive deeper into Tech-specific funding strategies, exploring topics like the true costs of equity, the role of debt financing, and innovative funding options for Tech startups and scale-ups. By adopting a tailored approach to capital management, Tech founders can better navigate the complexities of their financial journeys and position their businesses for lasting success.

Learn more about Funding Strategies

Growth Loans vs Series A or B

Tag: Funding Strategies

Bridge rounds for Swiss SaaS

Tag: Funding Strategies