Please note: This report has been curated by Agustin Nobili, Investment Analyst at Lendity, based on CB Insights' 1Q25 Report.

What Founders Need to Know

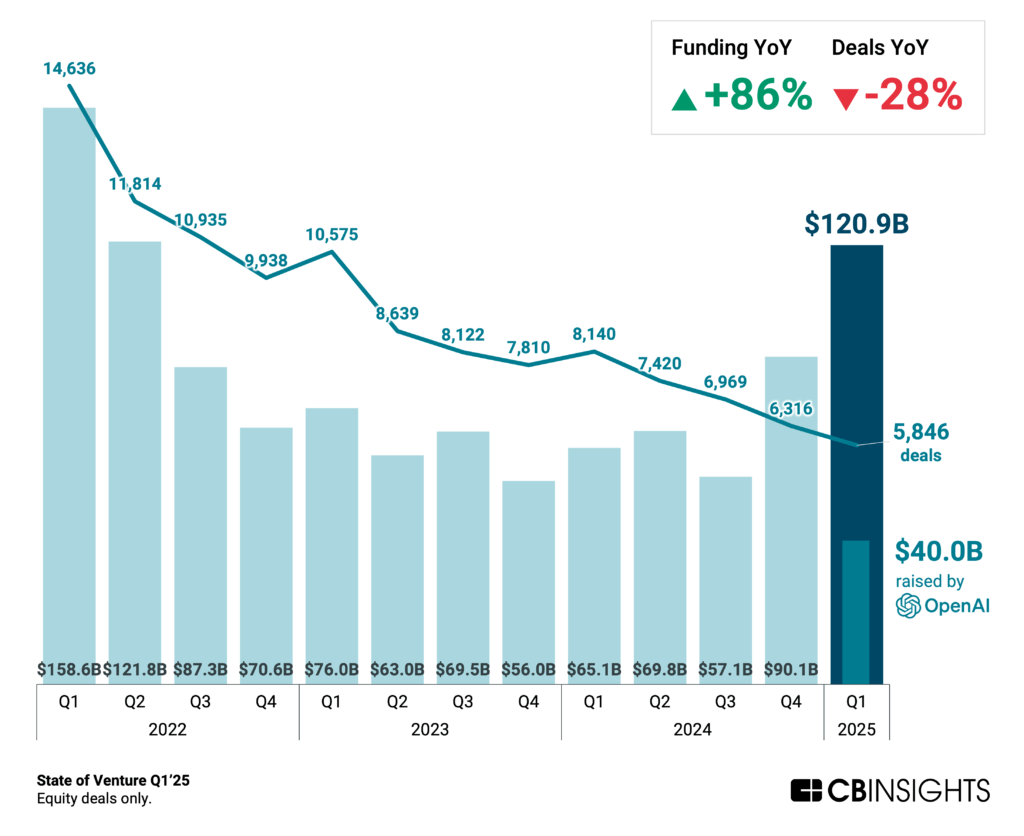

The CB Insights 1Q2025 report highlights a clear shift in the venture landscape. Global funding reached 121 billion dollars, marking the strongest quarter since mid-2022. However, that headline figure deserves context. Nearly one-third of all capital raised came from a single round: OpenAI’s 40 billion dollar fundraise. Strip that out, and the growth looks far more modest. At the same time, the number of deals fell to just under 5,850, the lowest since 2019.

For founders across B2B SaaS, including fintech, healthtech, edtech, and other verticals, this is a capital environment defined by focus. Fewer companies are raising, but those that do are raising larger rounds on stronger terms.

To succeed in this environment, founders need a deep understanding of how investor behavior is changing, what enterprise clients expect, and which signals matter most when building credibility in the market.

Source: CB Insights, State of Venture Q1’25 Report. All rights reserved to CB Insights. Full report link

Fundraising Landscape has Changed

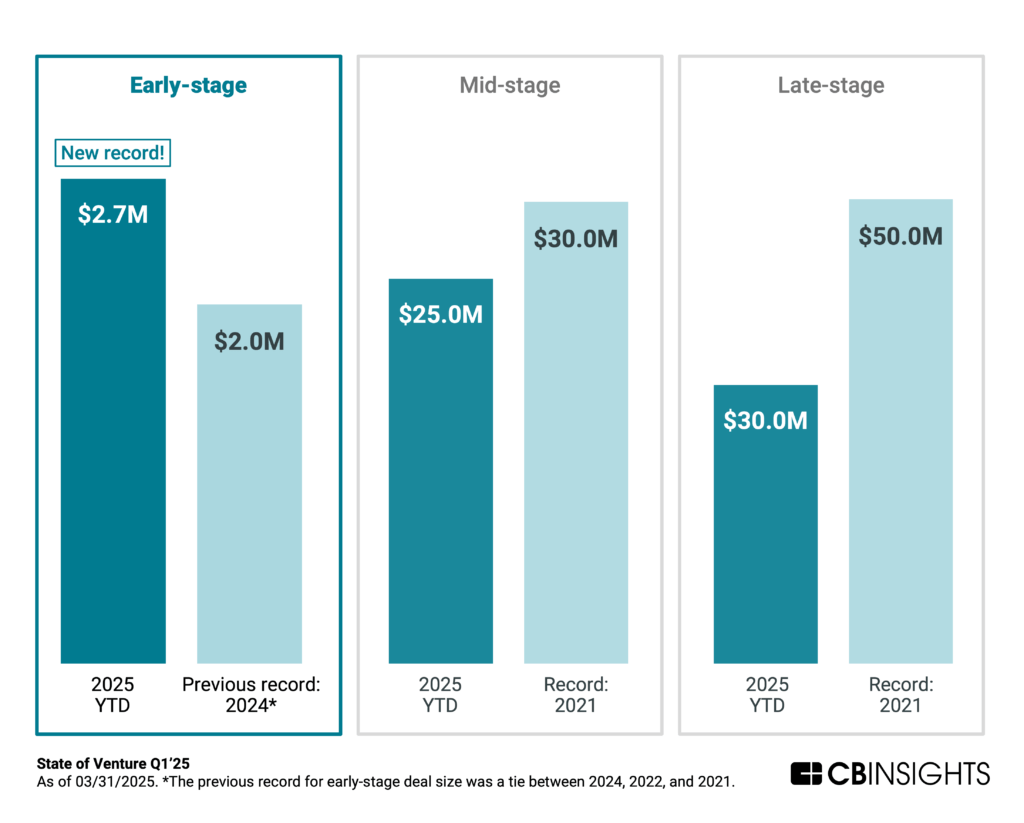

This is no longer a market driven by volume or hype. Early-stage rounds are increasing in size, with the median now reaching 2.7 million dollars. Several Seed and Series A rounds surpassed 100 million dollars, especially in companies operating in AI. However, the capital increase is not being distributed broadly. Instead, funding is being concentrated in companies that show early leadership and clear technical or market differentiation.

AI is playing a central role in this shift. Twenty percent of all global deals in Q1 involved AI, the highest share ever recorded. Still, claiming to build in AI is no longer enough. Investors are looking for practical application, defensibility, and clear commercial value. Founders outside of core AI categories, including those building vertical SaaS tools in education, legal, or logistics, need to show how automation or data insights drive efficiency or impact outcomes. Clear metrics and a tight narrative are essential.

Source: CB Insights, State of Venture Q1’25 Report. All rights reserved to CB Insights. Full report link

Source: CB Insights, State of Venture Q1’25 Report. All rights reserved to CB Insights. Full report link

What Investorsare Really Thinking

The rise in total venture funding this quarter is not a sign of widespread optimism. It reflects how capital is consolidating. Fewer companies are raising, but those that do are securing larger rounds with stronger terms. Investors are not stepping back. They are placing high-conviction bets behind companies that show early signs of category leadership.

Many of the largest rounds are no longer led exclusively by traditional venture firms. Corporate venture arms, asset managers, and crossover funds are playing a larger role. These groups tend to prioritize product strength, capital efficiency, and long-term market relevance over speed or storytelling. They are looking for companies that can scale with discipline and fit naturally into the broader ecosystem.

For founders, this means that raising a large round is not the goal. What matters more is being seen as one of the few companies in your space that clearly stand out. That comes from traction, retention, efficiency, and a sharp narrative around where you are going and why now is the right time.

The companies that raised in Q1 are already gaining ground. They have the resources to hire, improve their product, and pull ahead in sales. Others may face more difficult conversations. In this market, flat rounds, inside rounds, and bridge extensions are common for startups that are not demonstrating clear progress. To move forward, it is essential to understand what this group of investors values most and reflect that in your data and your pitch.

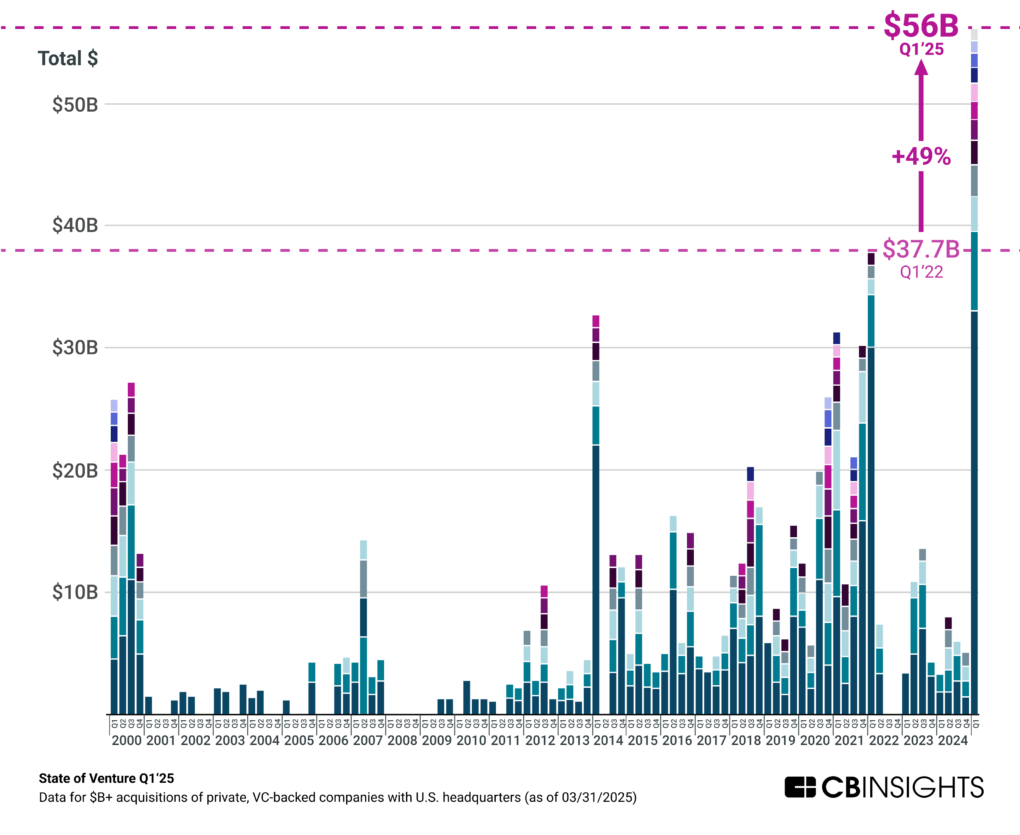

M&A is Back on the Table

Q1 2025 marked the strongest quarter for billion-dollar M&A activity since the first quarter of 2022. Twelve private tech companies were acquired for over one billion dollars each. This sets a new high for the current cycle and reflects renewed momentum in the exit market. The most notable transaction was Google’s acquisition of Wiz for 33 billion dollars. It is now the largest private VC-backed software exit ever recorded.

Strategic acquirers are actively pursuing companies again. This is not just a return to dealmaking. It reflects growing confidence among large incumbents in acquiring products that combine deep technical differentiation, customer traction, and clear paths to integration. For founders, this means M&A is not only back on the radar but should be considered part of the strategic planning process.

Source: CB Insights, State of Venture Q1’25 Report. All rights reserved to CB Insights. Full report link

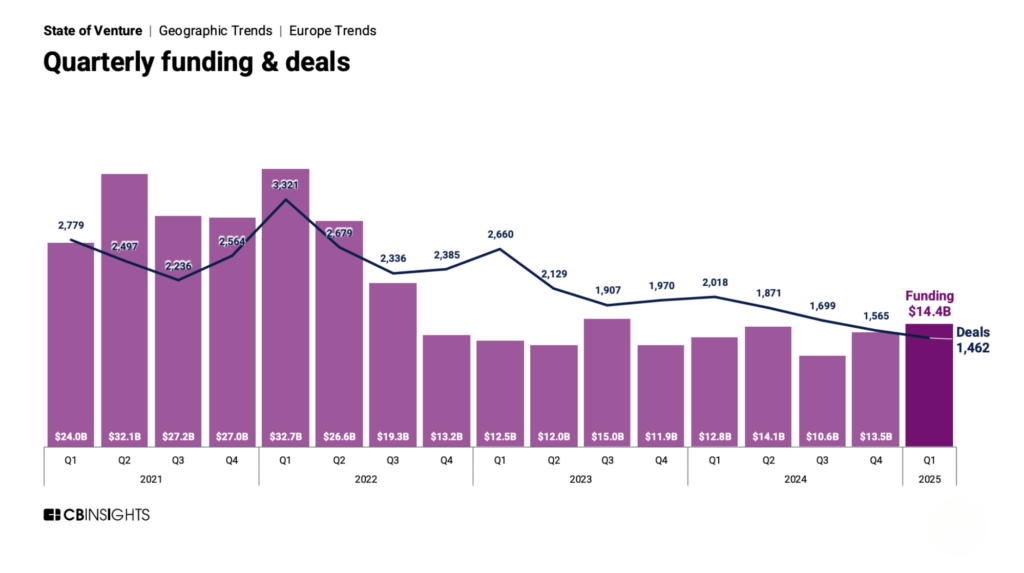

Fundraising in Europe: Focused, Active and Disciplined

While headlines focused on US mega-rounds, Europe quietly delivered its strongest quarter since early 2022. Startups in the region raised 14.4 billion dollars across more than 1,460 deals, placing it ahead of Asia in total capital raised. This marks an increase in total funding compared to every quarter in 2024, but also reflects a clear trend: the number of deals declined year over year. Capital is flowing, but it is being concentrated.

For founders, that means European investors are still writing checks, but with greater discipline. The market is rewarding startups that are solving harder problems, operating in regulated environments, or building defensible infrastructure. Speed and hype are no longer enough. Investors are leaning toward durability, clarity, and execution.

If you are raising in Europe or expanding into the region, it is still possible to access capital. But like in the US, you need to be among the companies that stand out. A clear story, strong unit economics, and credible use of technology matter more than stage or sector.

Source: CB Insights, State of Venture Q1’25 Report. All rights reserved to CB Insights. Full report link

Source: CB Insights, State of Venture Q1’25 Report. All rights reserved to CB Insights. Full report link

What Founders Expect Next

The dynamics from Q1 are unlikely to change in the near term. Capital will remain available, but it will stay concentrated. Investors are still deploying, but with more focus. The bar continues to rise. Founders showing traction will move quickly. Everyone else will need to justify their story with more than just potential.

The AI narrative is evolving. It is no longer enough to position around the trend. Founders will need to show how AI is embedded in the product, how it delivers measurable value, and how it supports defensibility. Usage, retention, and pricing are under closer scrutiny. Large checks are still being written, but they are going to companies that show discipline, not just ambition.

M&A activity is also picking up. Q1 saw a record number of billion-dollar exits, which is beginning to shift how later-stage investors think about upside. Acquirers are paying attention earlier. If your company aligns with strategic priorities in infrastructure, security, or applied AI, you may find new optionality in the second half of the year.

In short, the next two quarters will continue to reward sharp execution, strong metrics, and clear strategic relevance. The founders who can show all three will find that this is still a very workable market, just not a forgiving one.